Payday loan providers prey in the bad, costing Americans billions. Will Washington work?

The minimally regulated, fast growing lending that is payday strips Americans of billions annually. It’s the perfect time when it comes to brand brand new customer Financial Protection Bureau to implement laws to suppress predatory lending therefore that the $400 loan does not place a borrower thousands with debt.

Today, the Senate Banking Committee convenes to go over the verification of Richard Cordray, nominated to be the head that is first of Consumer Financial Protection Bureau (CFPB). With this historic time, as President Obama makes to produce a message handling the nation’s continuing jobless crisis, we urge our elected officials and also the CFPB leadership to focus on  oversight associated with lending industry that is payday.

oversight associated with lending industry that is payday.

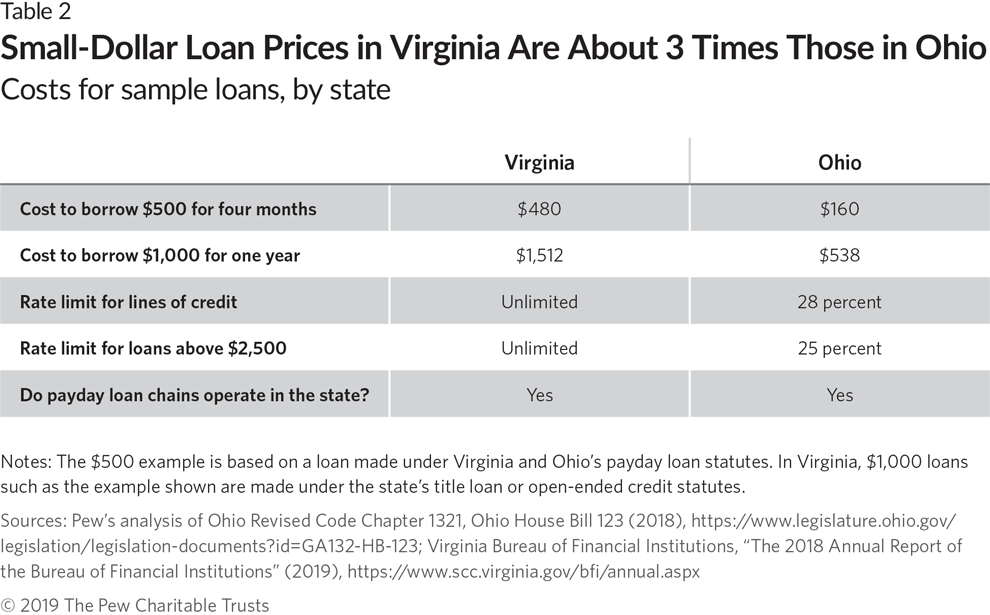

This minimally controlled, $30 billion-a-year business provides low-dollar, short-term, high-interest loans to your many vulnerable customers – individuals who, as a result of financial difficulty, need fast cash but are thought too high-risk for banking institutions. Read more →